2026 Global Gas Hob Market Trends: 5 Strategic Directions Brands Must Focus On

- Share

- Issue Time

- Dec 12,2025

Summary

As the gas hob market evolves toward 2026, brands are shifting focus from price to product stability, upgrade capability, and reliable OEM/ODM partners.

As global demand for home cooking appliances continues to evolve, the 2026 gas hob market is entering a new stage of structural growth. Consumers are upgrading toward safer, more efficient, and more design-driven products, while brands face rising expectations for compliance, engineering capability, and supply chain stability.

Below are the five key trends shaping the 2026 global gas hob landscape and the opportunities brands can capture.

Market Outlook 2026: Upgrading Demand & Resilient Growth

Despite fluctuations in raw material prices and logistics, the global gas hob category remains steady due to household replacement cycles, rapid urban expansion, and increased cooking frequency worldwide. What's changing is not demand volume, but demand quality. Brands are moving away from standard burners and basic models, shifting toward precision-controlled, higher-efficiency, and more compliant product lines.

For any gas appliance supplier aiming to stay relevant in 2026, designing depth and certification readiness will become fundamental competitive advantages.

Trend 1 — Precision Flame Control Become Core Expectations

Across global markets, consumers are shifting from basic open-flame burners to gas hobs that offer more controlled, predictable, and user-friendly cooking experiences. Instead of simply increasing power output, brands are now focusing on how precisely the flame can be managed and how intuitively the appliance fits into modern kitchen routines.

Upgraded burner structures, refined air–gas mixing systems, and smooth multi-level valve control allow users to switch from simmering to high-heat cooking with greater accuracy. This reduces accidental flame-outs, ensures consistent heat distribution, and creates a more premium feel even in mid-range price segments.

Brands that invest in precision flame modulation paired will be best positioned to capture the next wave of upgrades in 2026.

Trend 2 — Safety Compliance Becomes Non-Negotiable

From CE to SASO, and UL territories, safety certification is no longer optional. Flame failure devices (FFD) and quality traceability are shaping purchasing standards.

Retailers and distributors increasingly prefer OEM/ODM gas hob manufacturers capable of providing engineering documents, testing reports, and fast adaptation for country-specific requirements.

Trend 3 — Integrated & Premium Aesthetics Are Becoming a Market Standard

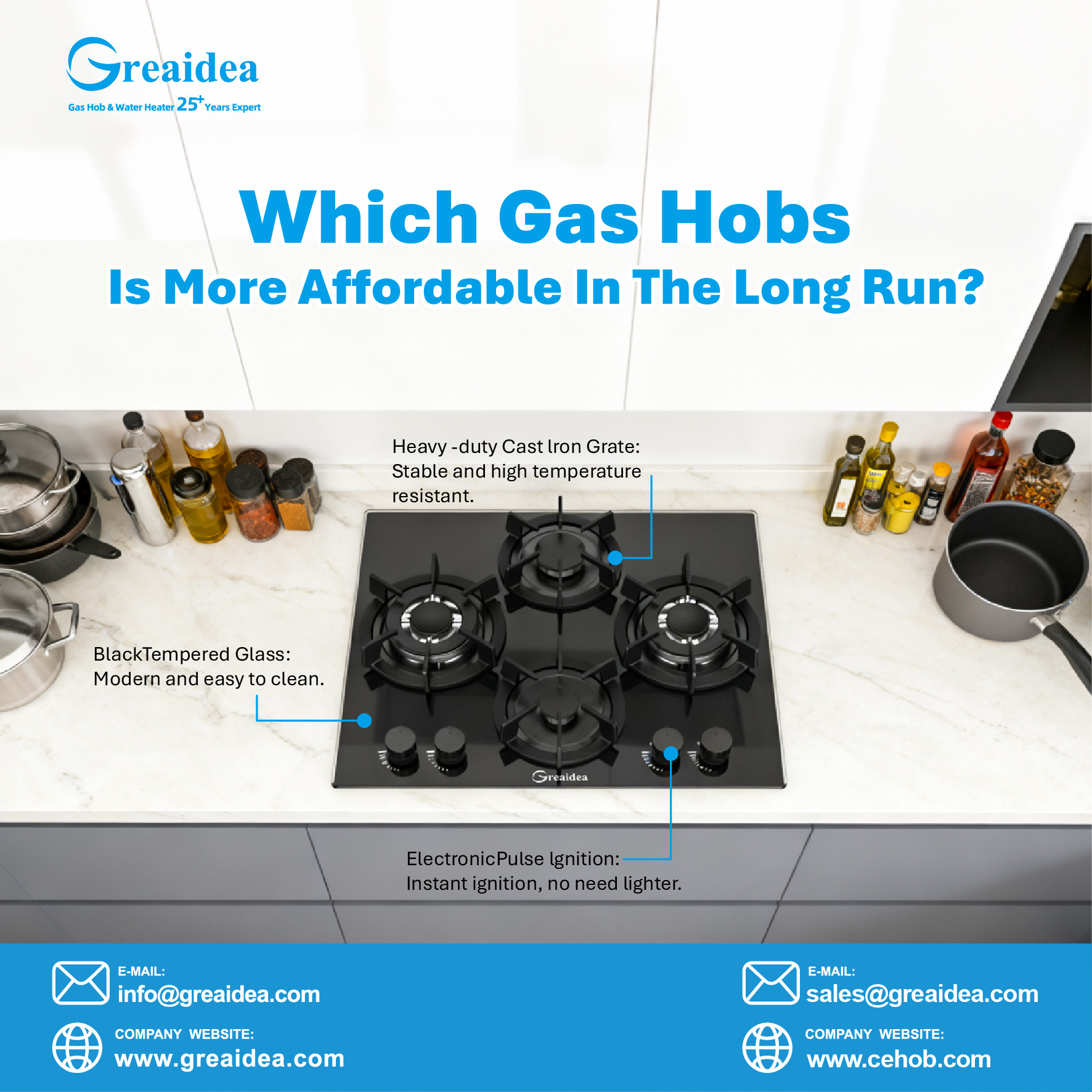

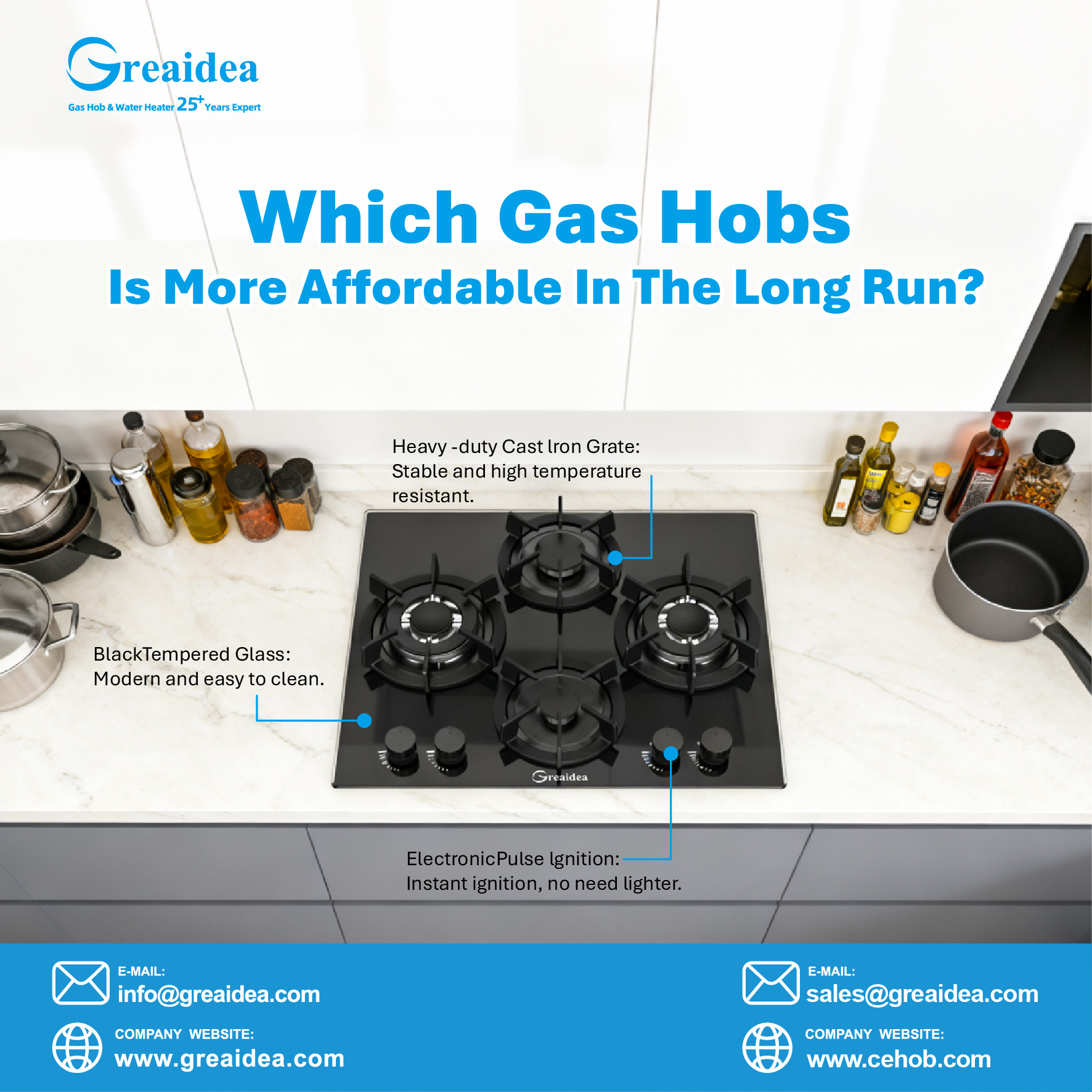

Across Europe, the Middle East, and Latin America, gas hobs with a more unified and premium aesthetic are gaining preference. Brands adopting refined glass or stainless steel surfaces, and cleaner control layouts are seeing stronger traction both online and in retail environments. Consumers increasingly expect appliances to match modern kitchen styles, and visual integration has become a deciding factor—often as important as burner performance.

For brands, this shift creates room to introduce premium-looking products at competitive mid-range price points, elevating perceived value without dramatically increasing cost. When the overall design—panel material, control interface, burner arrangement—feels cohesive and modern, it directly boosts conversion rates and positions the brand as forward-thinking in a crowded market.

Trend 4 — Functional Upgrades Define the Next Generation of Gas Hobs

Rather than full IoT systems, the market is moving toward practical, value-driven upgrades that enhance safety, control, and user confidence. More brands and distributors are actively favoring higher-end functional enhancements to upgrade existing models and refresh product lines, including flame failure protection (FFD), integrated timers, illuminated knobs, and multi-stage valve control. At the same time, many are transitioning from traditional mechanical knobs to LED-enhanced controls or touch interfaces, aligning gas hobs with modern kitchen aesthetics and evolving usage habits.

These evolutions are less about "smart appliances" and more about smarter product positioning—reducing after-sales risk, improving perceived quality, and meeting rising regulatory and consumer expectations. Brands that proactively iterate their gas hob platforms with these higher-value functions will be better positioned to extend product lifecycles and defend margins in competitive markets.

Trend 5 — Disciplined Product Structures Support Cross-Market Expansion

As brands expand into multiple regions, gas hob portfolios are being planned with greater discipline. In 2026, buyers are prioritizing built-in gas hob ranges that can be efficiently aligned with different market requirements without fragmenting production or supply planning.

Instead of continuously adding new models, successful brands are focusing on clear product tiering, consistent core specifications, and controlled variation, enabling smoother forecasting, stable lead times, and more predictable margins. This approach reduces operational risk while allowing distributors to scale across markets with confidence—making portfolio structure an increasingly important factor when evaluating long-term manufacturing partners.

Opportunities: Where Growth Will Come From

Looking ahead to 2026, growth in the gas hob category will be driven less by aggressive pricing and more by well-judged product upgrades and execution capability. Brands that focus on mid-to-premium positioning in growth markets, align performance with regulatory expectations, and use design as a retail differentiator will be better placed to defend margins. Equally important is development speed: shorter R&D cycles and fewer post-launch corrections increasingly depend on working with manufacturers that can translate market needs into stable, production-ready solutions.

A Manufacturing Partner That Aligns With Long-Term Brand Planning

As brands plan their next product roadmap, supplier selection is becoming a strategic decision rather than a sourcing exercise. In this context, Greaidea is frequently shortlisted by international buyers as a reliable OEM/ODM partner, supported by over 25 years of experience in gas hob manufacturing. The company works closely with global clients to balance combustion performance, safety compliance, and design expectations across different markets, while maintaining consistent production quality. Many partners across the Middle East, Latin America, and Europe credit this approach with helping them stabilize product performance, reduce after-sales pressure, and launch more competitive built-in gas hob ranges with confidence.

Preparing Your 2026 Gas Hob Line With Confidence

For brands currently reviewing suppliers or planning a product refresh for 2026, the priority is no longer just adding new models, but building a portfolio that performs reliably after launch. Manufacturers with proven OEM/ODM experience, multi-market understanding, and disciplined quality control can significantly reduce risk while supporting long-term growth. For those exploring such partnerships, Greaidea's team offers practical consultation, market-aligned development support, and stable supply capabilities to help turn product planning into measurable results. Contact Greaidea. Email: sales@greaidea.com Whatsapp: +8613380263203